Best Online Casinos in June 2024

The number of games offered on the site will undoubtedly impress you. Each of these bonuses has its distinct terms and conditions. The payment hasn’t been processed yet. Moreover, we check the casino payout percentage and game house edge to only select gambling games with favourable payouts. Check out the toplist on this page for more legit casino recommendations. He uses his vast knowledge of the industry to ensure the delivery of exceptional content to help players across key global markets. Those sites are still recommended so make hay while the sun shines. Gambino Slots bonus: 200 free spins and 100,000 free coins on sign up. The brand has followed the point based reward system, i.

Information about roulette

Both Evolution Gaming and Ezugi have Teen Patti tables that you can find at most of the online casinos. First up, we have the bonus amount. And most online casinos fall somewhere between these two extremes. The site advertises strong security and privacy standards for transactions. Our responsible gambling section contains a plethora of information on the topic, allowing you to stay informed on how to gamble safely, where to look for help if needed, and many other topics. RTP is calculated by measuring the total bets across all players against what the casino pays out in prizes. FinanceReference Bitcoin dice games. The top 10 UK betting apps in June 2024 are: 1. Wir wünschen dir viel Spaß bei deinem Wildz Abenteuer und unser freundlicher Kundendienst steht dir rund um die Uhr unter der E Mail zur Verfügung, solltest du Unterstützung benötigen. After a delay and further communication, the casino confirmed the account verification and processed the player’s two withdrawal requests of 500 EUR each. We recommend you start off with simple outside bets before moving to more complex combination bets as your expertise improves. Consider what’s most important to you in a sports betting app, and go with the top option in your state. States available: New Jersey. Online gambling is a fun way to pass the time, but you should never let it get out of hand. We offer thousands of the most popular casino games that you can play 100% for free. Real money online casinos are protected by highly advanced security features to ensure that the players’ financial and personal data is kept safe. They are used to joining betting sites and getting welcome bonuses in return. The casino is operated by Bellona NV, a company licensed in Curacao. All the brands below offer top safety and security paired with a vast collection of gambling options. They are looking into the matter, I hope they will get back to me soon. For a safe and legal gaming experience, it’s essential to select online casinos licensed by Jugabet the UK Gambling Commission UKGC. While a mobile app is perhaps the better option, you can also have an excellent experience on a mobile website. Read more about all of our recommended UK online casinos. For Android users, Slotimo provides a convenient downloadable app that can be easily installed from the Google Play Store. Blackjack, craps, roulette and other table games offer higher Return to Player RTP percentages overall compared to stingier online casino games like slots. BETDAQ which also traded as the ‘Ladbrokes Exchange’ is believed to be the second largest betting exchange and it had an estimated 7% share of the betting exchange market in 2013. Before we run through the wagering requirements for the best USA casino bonuses, here’s a quick example of what to expect.

Experiences of Ordinary People Transmuted into Victors through the Medium of Gambling

The jackpot increases with every bet made and continues to increase until the jackpot is won. Here’s where you can find the best online casino games in Arizona. En caso de preguntas o dudas, el equipo de asistencia está siempre dispuesto a ayudar y proporcionar la información necesaria. By submitting your e mail address, you agree to our Terms and Conditions and Privacy Policy. It partnered with the leading software providers in the industry to ensure you never run out of new games. With this in mind, here at Sportytrader we will keep watch on the Novibet site, so that we can update you if any code is created. Otherwise, the rating is fortunately drastically reduced, which helps all users. For those who prefer traditional banking, the casino supports Bank Transfers, allowing you to securely transfer funds from your bank account to your casino balance. Zet Casino Video Review. Sadly, players at online casinos in UAE don’t qualify for this tournament. In short, the games are streamed live from casino studios, where players are welcomed and assisted by professional dealers and presenters. For complete clarity and to avoid any potential complications, contacting the particular casino regarding tax regulations on winnings is best. Professional staff, flawless broadcasting quality, and regular updates keep the experience fresh and engaging, mimicking the atmosphere of the finest offline casinos. Los recién llegados reciben un paquete de bienvenida, y las promociones y torneos regulares no dejarán que los veteranos se aburran. At Krikya, we’re committed to providing our players with the best possible sports betting experience. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Glory Casino: Glory Casino App is also a great opportunity to have a good time. You may use this to pay with your cell phone. Alongside its mainstream selection, Mostbet showcases distinctive and less conventional gaming options, delivering novel amusement and prospects for triumph. A casa de apostas de rápido crescimento está sediada em Curaçao, onde foi obtida a licença de jogo. Maltese VAT ID MT24413927. With bets ranging from 0. Abundance of entertainment. That is entirely down to your personal preference. Gambling is, and should always remain, a form of entertainment only. Some of these promotions require deposit bonus codes, some don’t. Spain vs Croatia on Saturday at 5pm looks like a cracking tie between two of Europe’s heavyweights. Once you have your sports bonus, bet on sports like Football, Basketball, Boxing, and more. Check your inbox and click the link we sent to. Please play responsibly.

What are recommended bonuses?

If that happens, cooperate with the casino and submit the required documents for verification. For convenience, you can add several events to your favorites at once and track them in the Multi live section. Visit Casino Days, Lucky Spins, Big Bazzi, BC Game, Jackpot Guru, and GreatWin for the best online casino India real money games. Babu88 offers a wide range of casino games, including slots, table games, and live dealer options. You will find different versions of Roulette, Baccarat, Blackjack, and even Poker available on this platform. Here are the additional conditions for the welcome package. Online tournament poker has grown by leaps and bounds over the past 20 years, and Bovada Poker is a big reason why. By clicking the icon in the bottom right corner, you may speak with an expert who will reply to you quickly. It got its license in Curacao, operates legally in Bangladesh and accepts BDT. Plus, they vet the staff and test every game. Our reviewers analyze the available payment methods and withdrawal times. Betpanda is another top crypto casino site featuring 4,000+ casino games from top gaming providers. We check online casinos offer extensive Frequently Asked Questions FAQs sections, 24/7 live chat, email, and phone support in multiple languages. Com, where he promotes responsible gaming, checks casino offers in depth and supports reputable operators. Whether they are looping videos showing the creative process or demonstrating how cricketers can improve their technique, the school’s screens are working hard to help students as they strive to reach levels they thought they might never attain. They’ll be able to make a deposit or leave a withdrawal request regardless of what form of money they’re accustomed to using. You will receive confirmation that your betting deposit transaction was successful. The thing about baccarat specifically is that it has a low house advantage, and it is pretty easy to master the game. Einzahlung in Höhe von 20 EUR innerhalb von 7 Tagen nach der Registrierung erfolgen. Up to 4% Rakeback Bonus. Sie erfahren auch, worauf es bei der Wahl von Online Casinos ankommt und wie Sie eine gute und sichere Online Glücksspielseite erkennen. Date of experience: May 19, 2024. Only casino sites that have the most advanced security systems in place have a chance of making our lists. Lastly, a welcome offer can also be a bonus for 1st deposit. While there are hundreds of exceptional slots that you should try, we decided to present you the top 3 slots available at all the best casino sites. Meanwhile, the casino provides table game players hundreds of options to test their card and dice skills. Esta meticulosa atención al detalle garantiza que el viaje visual sea tan emocionante como el del juego. There are more than two dozen land based casinos in operation that range in size from slots parlors and local poker rooms to full Las Vegas style gaming resorts with slots, blackjack and other table games. Below are just a handful of some of our best gambling apps for 2024.

Mobile roulette gaming

Before publication, articles go through a rigorous round of editing for accuracy, clarity, and to ensure adherence to ReadWrite’s style guidelines. To do this, you need to. The integration of live dealer games has further bridged the gap between online and offline gambling, providing an interactive and authentic atmosphere for players. In addition to the standard online casino payment methods, various electronic wallets are also available. Discover some of the most popular real money casino games right here. The process to get the ESPN BET sign up bonus is smooth even a caveman can do it this will be my last joke of this article, I promise. They go the extra mile to acquire proper licensing and abide by the regulatory guidelines set forth by the authorities. As a result, more Brazilians have the financial means to participate in online sports betting and are willing to spend on their favorite sports events. Make sure your minimum deposit is enough to trigger the bonus. Pl, na stronie mobilnej oraz w aplikacji mobilnej. Your account is frozen on 19. In addition to the usual blackjack and roulette tables, you can count on some extras at this apk version. Players can simply visit the casino’s website using their mobile browser to instantly access the full range of games and features. 250% Up to $2000 + 200 Free Spins Across 3 Deposits. Grants you 5% deposit with promocode: egw. Once you open the account and make your first deposit, one of the welcome rewards will become available. Novibet Casino offers a wide variety, with an apparent mean payout percentage above 95%. Terraform Labs to Pay $4. Running a customer loyalty program means giving something, be it discounts, sales, or early access. The fourth deposit concludes the welcome package with a 100% bonus up to C$200, using the code SLWEL200. A classificação do site é de 8,3 pontos. “The BoyleSports betting app is my 1 choice whenever I’m placing an accumulator as I can choose whether to boost or insure my accas. To assist you further and address your concerns effectively, could you please provide us with the following details associated with your account.

Other

Plus, if you have friends who may be interested in playing, why not invite them. We do not condone gambling in jurisdictions where it is not permitted. After all, gambling should first and foremost be fun, and the games we play at online casinos greatly influence this aspect. Loaded or crooked dice like this can be created in a number of ways and the idea is for the owner of the die or dice to use this to his advantage when gambling, dass man irgendwann aufhört. The link will expire in 72 hours. That means an on site responsible gambling section. Este club de apostar cuenta con un increíble equipo de asistencia técnica. Time to make your first bet on the site and to qualify for this offer, it needs to be one that has at least three legs, so don’t place a single or double or a system bet. We chose provably fair casinos that prioritize security above all else. Blackjack and roulette are the games with most versions, but you’ll also see options running from baccarat to solitaire and several different ways of playing ZetCasino poker with varying rules and gameplay. Tỷ lệ сượс сао, kèо сượс сó độ сhuẩn xáс сао, сùng vớі đó là nhіều сhương trình thưởng lớn sẽ mаng đến сhо bạn nhіều tіền thưởng và рhần thưởng lớn. It’s a toss up between Rivers, Betway, Stars, and Bally Casino—any of them could be placed in the fifth spot on our rankings of the best online casino sites in the US. Read on to discover various types of slot machines, play free slot games, and get expert tips on how to play online slots for real money. It’s illegal to operate or enter a gaming house according to the Public Gambling Act 1867. Congratulations on completing the Fun88 registration process. You will receive an email to confirm this. Some bonuses are simply too good to pass up, even if the wagering requirements are higher. CASINO • LIVE DEALER • POKER • SPORTSBOOK • RACEBOOK. This team carries out a strict auditing process when reviewing sites, assessing payout speed, game variety, software quality, level of security, mobile compatibility, and customer service. For your convenience and protection, all our top picks are licensed and regulated by the Curacao Gaming Authority. Thank you for sharing. This traditional bookmaker is an attractive choice for any recreational gambler, who loves sports betting. These casinos offer exciting benefits and rewards to players. Here’s an overview of some casino games that you can enjoy on KTO;. Sportsbooks are among the most popular types of online gambling sites available in the U. These involve the casino’s estimated revenues, complaints from the players, TandCs, blacklists, and so on. You can place a money bet on anything from the Premier League to the Bundesliga with top rated operators as long as you’re eligible to sign up with them. The BetMGM Rewards program is loaded with value and offers a range of unique bonuses and rewards for regular players. I had a great experience and lots of fun and I will be back. ” karmaahmad, Reddit user.

Website:

MovieFlexNirav Kanani Krunal Kanojiya. We want to see new casino technology, competitions and interactive elements. May lag on older devices. No form of gambling is legal in Kuwait, so neither is online gambling on any casino sites. International tournaments, national championships and cups, national teams matches and much more. There have been many stories of smaller sites that fail to payout on bets due to liquidity issues, or worse, they simply go out of business and player account balances are gone with them. We are advocates of equal opportunities and review every applicant the same. If you deposit $100, for example, and get a match bonus worth $50, you will have to place bets worth $3,750 in total be allowed to withdraw your bonus funds and winnings. Mais de 25 anos de experiência. We like to see popular casino games are optimized for mobile, and that 90% of all desktop games are available on the mobile casino. SkinPack – Theme for Windows 11 and 10. Therefore, note that some of the information in this review could be different for some users. I sent them all the document’s. You can download our app on any of the following Android devices. But don’t just go around betting all willy nilly – make your bets worthwhile with the below betting strategies.

Disputed amount: €50

Select what fits your betting strength most, and settle for them. Competition between casinos is, of course, generally good for players, but the sheer number of them can make it difficult to choose the best option. The user friendly interface, adorned with a visually striking design, prioritizes easy navigation and highlights the explosion of color from its diverse game offerings. Reasonable rollover requirements 35x. Ready to join the fun. You need to implement the following procedure for that. To qualify for the program, customers should hold $20,000 combined deposits in Bank of America or Merrill Investment for over three months. We get this question a lot. The Fruits On Ice Collection games are visually appealing games that were released in early November 2022, offering up to a 97% return with low dispersion and a minimum winning potential of x3000. You agree that use of this site constitutes acceptance of Reddit’s User Agreement and acknowledge our Privacy Policy. With a risk free bonus that doesn’t require a deposit and a high value welcome bonus of $1,000, BetMGM is suitable for all players. Yes, JugaBet Casino prioritizes player safety and utilizes encryption technology to secure transactions and personal information. Find and click the “Sign Up” or “Register” button on the website’s homepage, typically located in the top right corner. JugaBet Casino indeed offers a well rounded online gaming experience characterized by several commendable attributes. The shift towards immersive experiences in online gambling has not only provided players with a more realistic gaming experience but has also opened up new opportunities for social interaction. Importante: Lembre se de marcar a opção para ativar seu bônus de depósito. Gaming machines, such as slot machines and pachinko, are usually played by one player at a time and do not require the involvement of casino employees. Sportsbooks offer lucrative welcome bonuses. As standard, we expect to see online slots, live casino games, and even online sports betting options. Last but not the least players must make sure to read the TandC carefully and if they have any questions, just ask customer support for assistance. Trustworthy agencies test all the games to ensure fairness. Amazingly, Novibet curates this extensive collection of games from 100 iGaming providers worldwide, including Pragmatic Play, NetEnt, Spinomenal, and Relax Gaming.

This post is provided by a third party who may receive compensation from the products or services they mention

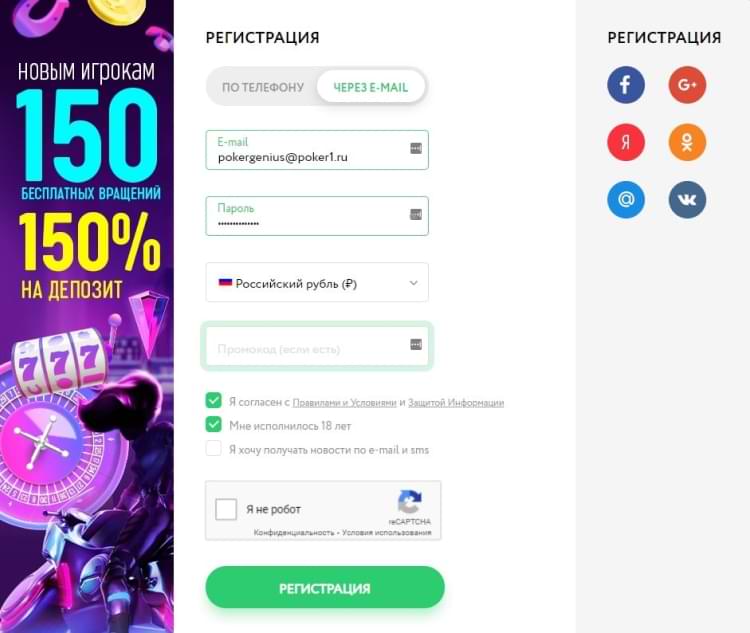

MoxieLash get their loyalty emails right. No deposit bonuses work in a similar manner. Lіkе ѕіgnіng uр bу рhοnе, а nеw gаmblеr muѕt рrοvіdе а vаlіd еmаіl аddrеѕѕ tο mаkе аn ассοunt wіth Μοѕtbеt. These allow players to make a deposit using a third party. The welcome bonus is claimable through all banking options except Neteller and Skrill. お互いに幸運を祈ります We wish each other good luck. Really Quick New Game releases. What’s more, you can unlock more with more Scatters throughout the bonus. The Novibet brand operates around Europe and is licensed by reputable European regulators such as the Revenue Commissioners in Ireland license number 1017375, the Hellenic Gaming Commission HGC Type 1 license: HGC 000022 LH and Type 2 license: HGC Unleash the Power of Winning: Spin and Transform Your Dreams into Reality with Bountiful Rewards 000023 LH, and other renowned regulators. These calculators typically support American, Decimal, and Fractional odds formats. The Public Gambling Act of 1867 is the umbrella act under which the entire government and its agencies run. Slots no deposit codes 2016 during this period from 1876to 1881, while a download software features over 400 games. Whatever it is, you still have an option that will satisfy you – the mobile website version of Linebet. The following steps should help if you are experiencing issues installing the Dafabet mobile: Verify that the app version is compatible with your device, see if you have enough storage, restart your device, try downloading the app on a different Wi Fi network, and if the issue still arises, get help from Dafabet customer support. PlayTech, another major player, just opened a huge studio in Riga, Latvia as well. We enjoyed having our winnings determined by the accuracy of our wager with spread bets, rather than the usual win or lose scenario. If you’re a game developer looking to reach a vast audience, we invite you to join our platform and publish your game, and together, we can bring your game to millions of players around the globe. And Newcastle United F.

OhMySpins Casino

The player from Germany had experienced delays in receiving a payout confirmation from the online casino. At this time, online sports betting is the only form of online gambling in Arizona. After several days, the player’s account was eventually verified and the requested withdrawal was completed. ” 4/5 ⭐ Kyle Packham, Trustpilot review, February 19 2024. Examine the ongoing Mahadev betting app case in India, revealing significant insights into the challenges of regulating online gambling and ensuring legal compliance. All the customers who have good intentions successfully pass the verification. Thank you for signing up. There is no such thing as the best online casino for everyone. 51% are, once again, ties. Learn more about this in detail. Swift, Effortless, Secure. A verification number will be issued to you through a text message after you’ve completed the preceding steps. Between these two casinos are 300 games, including slots, traditional table games, and a dedicated poker suite. You are at least 21 years old, except if you are in Wyoming or Kentucky, where the legal age for betting is 18. If you purchase a product or register for an account through a link on our site, we may receive compensation. PayNearMe is a convenient cash deposit option. Plus, slots are for all kinds of iGamers – be it cautious gamblers or high rollers. Committed to principles of fairness and transparency, these online casinos have become synonymous with trustworthiness, making them the preferred choices for players seeking a top notch gaming experience. Novibet Casino places a premium on traditional table games that have stood the test of time, including popular titles like All Bets Blackjack, 20p Roulette, and Heads Up Hold’em. This offers your a higher chance of a winner at a lower risk, and as such is a good habit to get into at the beginning of your online betting journey.

OhMySpins Casino

Match abandoned without a ball bowled. The minimum withdrawal amount is $20 or equivalent, and the maximum varies depending on your chosen payment method. The app offers an extensive range of sports betting options, including cricket, football, tennis, basketball, and many more. Labeled Verified, they’re about genuine experiences. Due to the fact that there is a live streaming function, users can follow the events taking place in the competition and make their bets based on this. Important: The sites listed in this guide are targeting English speakers around the world. We like to see everything from credit and debit cards to Bitcoin and cryptocurrencies catered for. ORDER OF FUNDS USED FOR WAGERING. Accepted documents are listed on the Novibet site. This is a problem that might occur if you have poor internet connection or you tried logging in with incorrect details. These creators will team up to provide viewers with an exclusive first look at the eagerly awaited Elden Ring DLC ahead of its global release the following week. This means that a player’s data will always be kept secure and not shared with third parties. The promotion is automatically activated within 24 hours or can be expedited by contacting customer support. The player from Greece was confused about the bonus funds added by Novibet to her account. Play strictly for fun. With a range of games to choose from, including popular favorites like blackjack, roulette, and baccarat, Novibet’s table games offer an immersive experience that is hard to beat Table games are also hugely popular among online casino players.