If you have already dropped out, you may have to undergo a medical exam before you get your coverage back. It depends on the plan, but your insurers can give you guidance. For example, they may say that the children’s expenses are applied first to the parent who has the earlier birthday in the year. This is the second time I have used Tempcover.com and once again the policy could be arranged in minutes, all exceptionally easy to complete online and documents are emailed to you on completion. Tempcover has provided temporary vehicle insurance to hundreds of thousands of drivers for over 15 years.

But in other cases, the added premium payment and deductible might increase your overall health expenses and cause further complications. People insurable under double insurance must meet certain qualifications. Typically, the insurance must come from a group health plan provided by employers, select organizations, or the government. Spouses may add each other to their respective insurance plans as dependents while their children who work but are still regarded as dependents may be insured under the policy offered by their employer and both their parents policies.

The issue is that the term of these ‘other insurance’ clauses is not standard & this can leads to disagreement between insurers as to which insurance policy should respond, leaving the business waiting for a claim. If either of the policies entails such a clause, then there is no issue for the insured, as the clauses cancel each other & the insured can claim in both insurance policies for its loss . DUAL is one of the world’s largest international underwriting agencies and also one of Lloyd’s largest international coverholders. Some of the world’s largest and best-rated insurance and reinsurance companies back DUAL.

When a person is covered under two health insurance policies, it’s a form of double insurance. As a starting principle, an insured cannot profit from their loss or make a claim twice. However, where a policyholder is insured by multiple policies, they can choose which policy they wish to claim under. This is worth bearing in mind when insurers draft or amend policy terms and conditions.

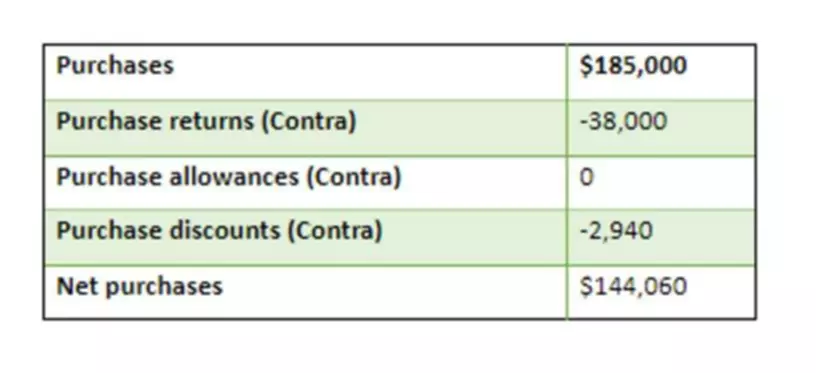

Typically it’s a small fee, such as $15 or $25 for your primary doctor. However, the copay might be higher for a specialist or other service. In other words, don’t expect that if you pay a deductible on one plan, it will eliminate your obligation for the deductible on the other plan. In many cases, the benefits of having a second plan are modest. Double insurance is possible only when the insured gives his consent for it. In contrast, in reinsurance the consent of the insured in not required.

How Does Having More Than One Health Plan Work?

Dual car insurance isn’t illegal – you may find yourself accidentally doubling up on cover in many scenarios. For example, you may not realise that your policy has automatically renewed and take out a new one. Or you could buy a policy for a new car, not realising that it comes with free drive away insurance. Insurance is only meant to put you back in the position you were in before the event you claimed for.

In finer terms, reinsurance is a contract between the ceding company and the reinsurer, for sharing the risk of the insurance policy, in exchange for a share of the insurance premium. Therefore, if a business does claim under one insurance policy & not the other, the insurance company that has not paid out probably has to pay a share to the insurer who has paid out. Upon review of the respective policy wordings, the judge held that the HSBC policy operated only as an excess policy to the NFU policy. Since the NFU policy provided cover for the same risk, the excess clause was triggered and the HSBC policy did not cover the buyer.

- Having two health plans can help cover normally out-of-pocket medical expenses, but also means you’ll likely have to pay two premiums and face two deductibles.

- When both health plans combine coverage in the right way, you can avoid a duplication of benefits while still getting the health care to which you’re entitled.

- The first losses are addressed by one insurance company to the prescribed limit; above that limit, another insurance company will pay out up to the limit cited in that policy & so on.

- The original insurer cedes a proportion of its business to another insurer, in essence, the risk is signed and accepted by that insurance company.

- A child’s parents each have access to a health plan at work.

Under the coordination of benefits in many group plans, your secondary insurer can cover what your primary insurer does not. Often, benefits are only covered up to a certain percentage and up to a maximum amount per year. With two plans, you can end up recouping 100 percent of your out-of-pocket costs.

Benefits of Having 2 Health Insurance Plans

She has been involved in the insurance industry since 2001, including work as an agent. Sage attended college at Indiana University South Bend, and received her property and casualty insurance license from the Professional Training Institute of Mishawaka, Indiana. Dual insurance is a phrase that is commonly used in the insurance world, and you’ve probably heard it discussed when the topic of insurance comes up. We recommend that owners leave insurance matters to the body corporate. Should an owner feel the need to increase the insurance value on their section, a request should be put to the body corporate as prescribed in Regulation 23 of the Act.

An insured who seeks to apply for more than 100 per cent of the value of a claim or seeks to claim twice against different policies would be considered fraudulent. Double insurance should dual insurance not be perceived from a coverage layering viewpoint. Layering is where insurance policies are placed with distinct insurance companies to safeguard different exposure levels.

Non-Duplication – The Secondary insurer calculates what its expenses would have been had they been the Primary insurer, and then compares against what the actual Primary insurer paid. If the Primary insurer paid more than the Secondary would have, then the Secondary pays nothing. Otherwise they pay the difference only of what the Primary paid, and what the Secondary would have.

A child’s parents each have access to a health plan at work. Children can be covered under both plans if the parents decide to include them. That’s usually a good thing, but if you pay premiums on both plans, you can shell out more than you get back. Know the risks of leaving a plan before you say goodbye, because if may be tougher than you think to get back in. This, of course, doesn’t work the same way for policies such as home insurance policies which promise to replace an item on a “new for old” basis if you make a claim. This type of “betterment” is promised in the policy wording and is therefore not considered fraud.

In certain situations, seniors who are 65 and still working may be covered under their employer’s plan and eligible for Medicare. It’s important to understand how your particular insurance plans work together in order to get the most coverage. You’re an injured worker who qualifies for worker’s compensation but also have your own insurance coverage. In double insurance, the insured has an insurable interest in the insurance contract. On the contrary, in reinsurance, the original insured has no interest in reinsurance. At first instance, the Lloyd’s policy escaped any liability, the court finding that this was not a case of double insurance and that the Allianz policy responded whereas the Lloyds one did not.

The first losses are addressed by one insurance company to the prescribed limit; above that limit, another insurance company will pay out up to the limit cited in that policy & so on. People with more than one health care plan should discuss with their health plan providers how combining plans will work with their plans. This way, they can see what health care coverage they can expect.

If you have two insurances, will you have a copay?

Some states even offer Medicaid-Medicare plans that offer more coverage options. Once you’ve named one plan as your first plan, that plan will pay what is required without looking at what the second plan covers. Once the main plan has paid the costs it has to pay, the second plan will be used. If you have two health plans, you may be asked to declare which one you want to name as your main plan.

What is the dual car insurance law?

The other plan may offer better coverage in some other area. You can get the best of two health plans when you combine care. Many Canadians have extended health insurance through their employer. Most group plans cover you, your spouse and your dependents. So, if you and your spouse both have workplace coverage, you may be entitled to similar benefits under both. It’s essentially the idea that you take out multiple insurance policies covering the same type of risk on the same subject, whether that’s a car, a house or a gadget for the same period of time.

Coordination of benefits decides which plan pays first and which pays second . DUAL North America is one of the largest independent underwriting organizations in the US with over 25 unique programs across commercial property, casualty, and financial lines. We bring in underwriting experts across the country and provide industry-leading technology to enable the best results for our partners. Specialized underwriting organization in the U.S. offering property, casualty, and financial lines programs. The leader in expert underwriting, technological solutions, and superior service for producers and carriers. In common law countries, the right of contribution between insurers arose out of equity.

We maintain strict editorial independence from insurance companies to maintain our editorial integrity, so our recommendations are unbiased and are based on a comprehensive list of criteria. In cases where the insured and one of the insurers are in litigated proceedings, the insured may choose to sue all other insurers also liable for the loss. If that happens, then the UAE courts will usually apportion liability for the loss ratably between all insurers, subject to any countervailing terms in each insurer’s policy. Whether the right to contribution among insurers is available or not, the condition necessary for a claim of contribution is the existence of dual insurance. Insurance companies are required to honor double insurance policies.

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below. A complete spectrum of legal services across jurisdictions in the Middle East & North Africa. The Indian Government introduced the Insurance Ombudsman scheme for the Individual policyholders to resolve their g… DUAL is well known for our underwriting expertise and across all our teams our vision is to be the best underwriting business in the world.

My legal indemnity shop

Double insurance coverage occurs when two health insurance policies cover an individual. This can happen if an individual has both employer-sponsored health insurance and an individual health insurance policy or if an individual is covered by their spouse’s health insurance policy as well as their own. Some policyholders have two health insurance plans rather than just one. For example, some seniors enrolled in Medicare also have a health insurance policy through an employer.

From these extracts, it is clear that it is the duty of the body corporate to arrange insurance as prescribed. “Depending on the type of plan you have, there is not necessarily a pass-through or a honoring of a deductible from one plan design to the next,” Mordo says. Select the products that matter most to you so you can have the most relevant and up-to-date information possible.